Key Takeaways

• Understand the difference between retail banks and investment banks.

• Review the divisions that exist within an investment bank.

• Understand the core capability of each division within an investment bank.

My first blog on financial services...

For the past 5 months I have written about the software engineering practices and tools I encounter on a daily basis. I have decided to begin writing about financial services to accompany my technical blogs to reflect upon the context of my job. My bachelors degree and first job aligned to investment management and I continue to find the industry interesting, even more so due to the growing importance that technology plays in the long-term strategy for all the players within the industry.

Introduction to financial services

Financial services can be divided into many sections, in this blog, I have split financial services by the clientele they serve into retail (also known as commercial banking) and investment banking. Both types of banking involve the matching of 'buyers' and 'sellers', however they differ greatly by 'who' they serve.

Retail banking constitutes a service that is provided to individuals and small business owners who would like a loan or mortgage for their livelihoods. The bank will offer a loan to the mortgage buyers with an interest rate of 'r' (e.g 3%) on the repayments. On the other side, the retail bank will also accept deposits from sellers who wish to save their excess funds. The seller is enticed to deposit their money for an interest repayment on their savings of 's' (e.g 2%). The retail bank will earn a profit through the loan repayments where 'r' is greater than 's' (e.g 1%). This is a general idea of retail banking in the public sector, there are many more services provided within retail banking, however the remainder of this post will look into the operations of an investment bank.

An investment bank provides advisory and funding services to customers including corporations, high net worth individuals (HNWI), and government entities. The services provided enable the use of capital markets for the clients and involve much larger volumes of capital. As a result, investment banking can be a more lucrative sector within financial services.

Divisions of an investment bank

The umbrella term 'investment bank' can often take different definitions and meaning. 'Investment bank' must not be mistaken for the 'investment banking division' as the latter is used to describe a group of functions performed by an investment bank. The divisions are used to group the services provided by the bank and are categorised based upon the clients that are dealt with, the services provided, and the style of revenue generation to the bank. The divisions of a bank also supports the regulatory compliance towards information sharing, I will touch upon this topic later.

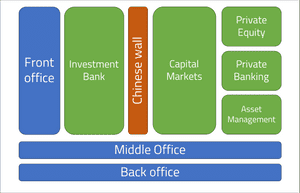

The image below illustrates the divisions that can exist within an investment bank.

The 'Chinese wall' that splits the investment banking division from the others is a virtual information barrier to separate non-public information and public information. The investment banking division will often have access to non-public information due to their research and client services, and must therefore use to a Chinese wall to prevent insider information from spilling into the other divisions.

Some banks will define themselves as an investment bank when they provide services across multiple divisions, however other banks, which specialise in a certain division, will identify themselves to the division. For example Charles Stanley Wealth Management vs Barclays Investment bank.

Core services of the investment bank

In the following section, I will describe the core services of each division. The terms 'buy side' and 'sell side' are often used to describe the nature of revenue generation for the function, they are briefly defined below:

Buy side: services involved with directly investing capital to purchase securities.

Sell side: services involved with issuing, selling, or trading securities and advisory services.

Investment banking division (IBD)

Underwriting

Underwriting is a primary service within IBD. The process of underwriting sees the bank support a client (business, corporation, government) with raising capital through the sale of stock (equity) or bonds (debt). The investment bank will receive a percentage of the overall value of the underwritten securities as compensation.

The underwriting process can take the form of either an initial public offering (IPO) or a follow-on offerings. An IPO refers to the process of offering the shares of a private corporation to the general public (thus making it a public corporation). The issuance of new stock is used to raise capital for the corporation. A follow-on offering is the issuance of stock after the IPO. During the IPO, the investment bank will make one of three agreements for underwriting:

• Full commitment. The investment bank will buy all the securities and sell them in a secondary market.

• Best efforts. A good faith promise is made to sell as much of the security as possible.

• All or none. The IPO will only go ahead if all the securities are sold.

Market Making

As a market maker, an investment bank can act on both sides of the sale for a security. A bid (buy) and ask (sell) price can be quoted by the investment bank and a profit can be realised from the spread (ask - buy) of the security when it is later sold. The investment bank will take on a risk of holding a security as it may depreciate with time, however their market making services provide liquidity to a security that would otherwise not be sold in the market.

Advisory

Advisory services include research and guidance on M&A (merger and acquisition) and corporate strategy.

The M&A advisory service includes the negotiation and structuring of a merger or acquisition between two corporations. The corporations can be public or private, and the investment bank are able to provide support through their expansive network to find partners and deep-grained industry knowledge on the markets.

Corporate strategy advisory can be used to support the short and long-term strategic direction of corporations in the ways of financing change.

Asset management division

The asset management division is responsible for managing a fund of financial holdings from investors that a risk tolerance and short and long term goals. Investments will be made across instruments such as stocks, bonds, real estate, commodities and derivatives (futures, options, swaps). The client can be HNWI as well as high-end institutions. The relationship between a client and the fund manager is important to maintain as the clients may seek support in reevaluating goals or understanding the opportunities that lie ahead. The service of asset allocation provides advice on how to divide investable assets into growth products (stocks) and fixed income produces (bonds).

Funds will be managed by a portfolio manager who will utilise the research and guidance of their teams to make investment decisions upon the fund. The fund will have a specific criteria to adhere to including the risk tolerance, type of securities that are invested upon, and liquidity.

Capital Markets division

Capital markets are where suppliers with excess capital and those in need of capital meet to satisfy their ambitions. Capital markets in this sense are similar to retail banks with mortgages and savings accounts, however the entities involved are corporations, governments and dedicated individuals who understand and trade upon the market. Securities are exchanged within a primary market of newly issued securities and secondary markets for re-sold securities.

Sales

The sales component of capital markets will be responsible for suggesting trading ideas to their clients and to take orders from them. The sales component will also consist of financial analysts that provide support in research and strategies. Once made, the order will be communicated to the trading desks where they are priced and executed.

Proprietary Trading

Structuring

Structured products provide access for retail investors to derivatives by using complex strategies to switch the underlying payment flows of a security with a fixed value that is derived from a derivative. The complexity of a structured product will require a blog itself to explain, however the summary is that it provides access for retail investors to complex derivatives.

Private Banking division

The private banking division is split into two separate services that cater to HNWI: private banking and wealth management.

Private banking provides a personalised and concierge-type service to HNWI for managing their finance. The products offered within private banking are largely identical to those offered within retail banking, however the client to the bank will experience a personalised level of service. Private banks will often use a 6-figure benchmark as a deposit for clients of the bank. The private bank will also offer advisory services for planning, retirement, taxation and inheritance for the client when managing their assets.

Wealth management involves the optimization of a client's portfolio of assets with regards to the individuals risk, goals and asset preference. Wealth management is more closely aligned to the growth and protection of the clients assets and includes services such as estate planning, retirement planning and education planning.

Private Equity division

The private equity division will invest in private institutions with the objective of achieving a mark-up in their value and a return on service fees. Private institutions will not have had an IPO and are therefore not traded on the stock exchange. The private equity division will have many funds that consist of investments from HNWI, corporations, and also loans from banks. The fund is used to purchase multiple private institutions to renovate or provide advisory services to. The growth and enhanced performance for the acquired institution will eventually drive the share price up enabling the private equity fund to realise the profits on the resale of the institution. The private equity division will realise profits from a fee of managing the fund and from the percentage share in the fund they had when the private institutions are sold.

Conclusion

Financial services is a broad industry that incorporates a vast array of services from advisory and research to execution and market making. The differences between these services can depend upon the client being served, the institutions being managed, and the active involvement with investments themselves. Services can be split between 'buy side' and 'sell side', however the overarching principle within financial services is to aid in the movement of money. This blog has only touched upon the functions of each division, however I will use this as a foundation to reflect upon in later posts when I look slightly deeper into how financial services works and why technology has such an influential role in strategy.